The environment and landscape which Directors and Officers navigate daily is becoming more complex and riskier. Regulator, investor and public expectation of boards continues to intensify, and personal accountability for not meeting these expectations is increasing. The shift from corporate responsibility to personal responsibility continues at pace. When these expectations are not met the tendency to take legal action is now given extra ‘fuel’ by the further emergence of collective actions, including:

- Increased capital flow into shareholder activism and the growth of litigation funding, which is now seen as an alternative asset class producing high returns,

- Boards operate under this spotlight in uncertain economic and political times where equity and asset price volatility are the norm.

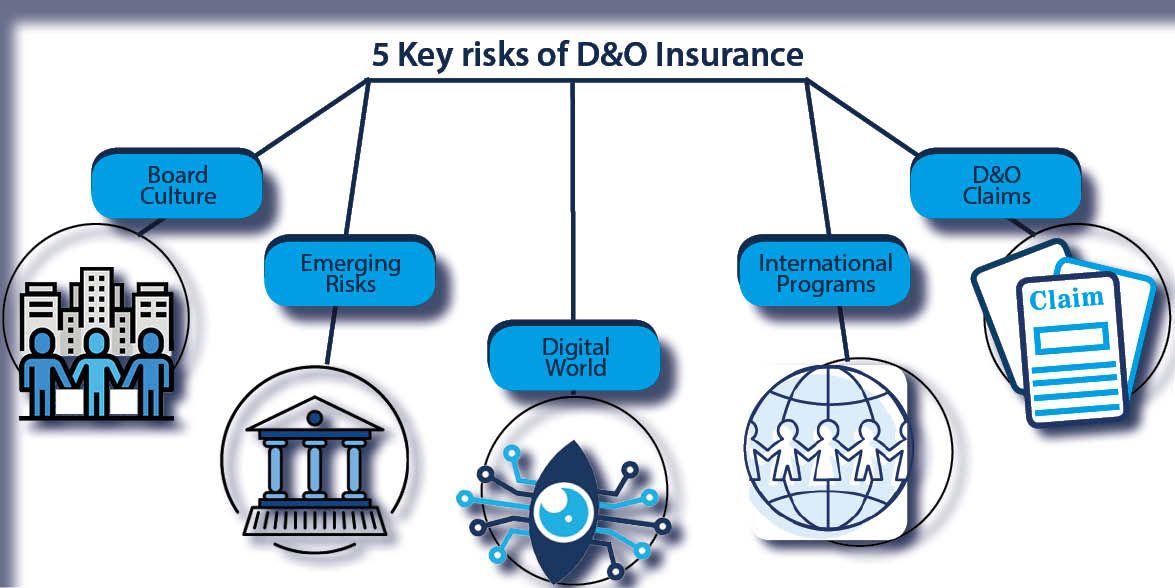

There are numerous global and regional trends that Directors and Officers need to stay on top of during 2020;

Board Culture

Boards are expected to set the tone for an organization’s culture and a poor culture is a key indicator for potential D&O claims. A major factor in many claims we see is compliance failings.

Emerging Risks

A failure of boards to recognize, manage and mitigate several Emerging Risks including cyber risk, protecting intangible assets and reducing intangible liabilities, protecting brand and reputation value and addressing climate change disclosures. There have already been incidents where investors have sued boards for a lack of oversight following cyber events.

D&O Claims

Cross-border trade, supply chains and international co-operation of regulators continues to make the cost of defending and settling D&O claims more complex and costly.

Digital World

Boards face an increasingly digital world where efficiencies and productivity are measured. Strategic decisions and investments in the “Internet of Things”, blockchain and Artificial Intelligence are being made daily. These decisions and investments will be scrutinized by shareholders.

International Programs

International Programs are growing in popularity and need as cross-border risk evolves with collaboration among regulators, insurance and tax entities. Ensuring the D&O insurance policy is fit for purpose in the local market can be crucial at the time of loss. This is of critical importance when a non-indemnifiable claim is made against a director in a country where non-admitted insurance is not allowed.

Corporate governance remains in the spotlight and a focus of integration of social, environmental and economic issues into reporting disclosures, continues.

Article Credit: Allianz Global Corporate & Specialty UK