If ever there was some confusion about the roles of an insurer and those of a broker, they may have been cleared during the chaos of COVID-19.

- An insureris a company that provides cover for damages or losses you might suffer based on the policy you have in place. This policy forms the contract between you and the insurer. The insurer is paid premiums, holds the risk, and pays claims as defined by the contract e. the Policy. Insurers are not able to engage with you (the client) directly, and as such the role of the broker becomes important.

- An insurance broker is a specialist in insuranceand their core function is to provide advice to you and act as an intermediary between the insurer and yourself. They determine your needs, help you identify risks and look to the insurance market to find and negotiate the best possible cover to meet your identified needs. The broker has a duty to ensure that you understand the cover provided and, within reason, any uninsured risks.

The importance of a specialist broker is only made obvious in complex industries such as ours, sadly, at claims stage.

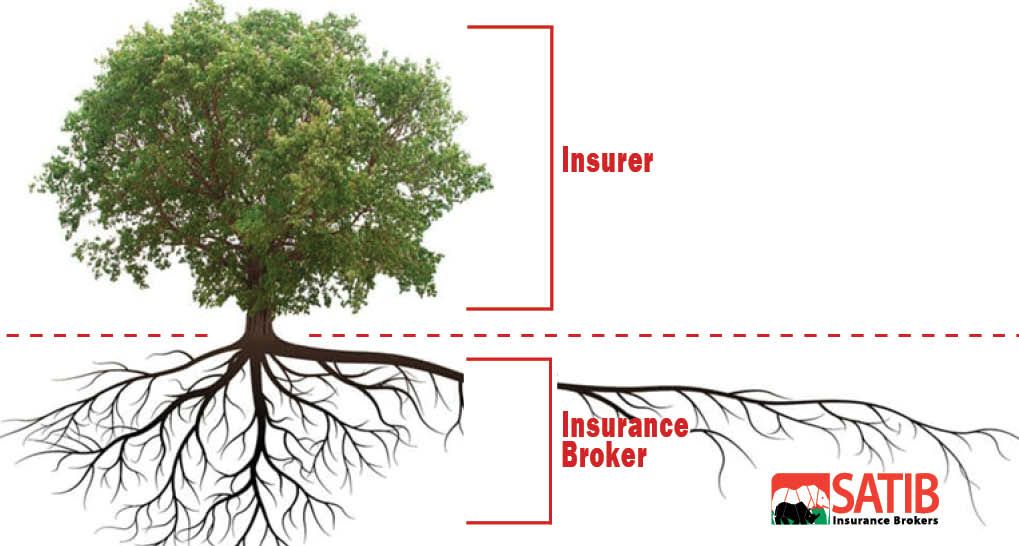

Your insurance provider may be the tree beneath which you seek refuge when trouble lashes your business and livelihood. But your broker is the sturdy root system, working hard at ground level ensuring that your needs are met and always advocating on behalf of your interests.

At SATIB, we have helped navigate our clients through the squall of Covid-19. We have stood unwavering in our engagements with insurers to bring about meaningful relief for the tourism and hospitality industry. We have continued to provide guidance to COVID protocols through SATIB24 incident management services for teams who have remained on the ground. At SATIB, our business is so much more than policy wordings and premiums—we aim to safeguard an industry that is the custodian of our heritage and puts food on the table for 1 in 10 South Africans.

Whether you’re happy with your insurer or looking for a change, make sure you are supported by a specialist broker, who takes time to understand your needs, and that you can trust.

Moving to SATIB, will not prejudice your current policy, cover, or existing claim. We can help you further motivate your claim and assess your insurance needs in this time of great change—to make sure you’re never caught out in the storm again.