Not so long-ago cyber-crime was something that we witnessed only the big screen in movies such as Disclosure (’94), The Net (’06) and Anon (’19). When the buzz around Y2K hit the world, we suddenly became aware that Hollywood had provided the world with a stern warning and not simply entertainment.

Fast forward 20 years, from Y2K, and business has embraced the digital era as practice to conduct efficient business. Cyber, one of digital’s parent categories, has allowed businesses to expand their reach and empower their operations to get more done, while saving more time, through interacting with a network of more clients and other businesses globally.

It’s human nature to ignore threats until they hit close to home, however, with the ever-evolving digital landscape, and vast amount of confidential client information passing through business systems, the word ‘ignore’ and ‘ignorance’ when discussing cyber protection should not be part of the vocabulary.

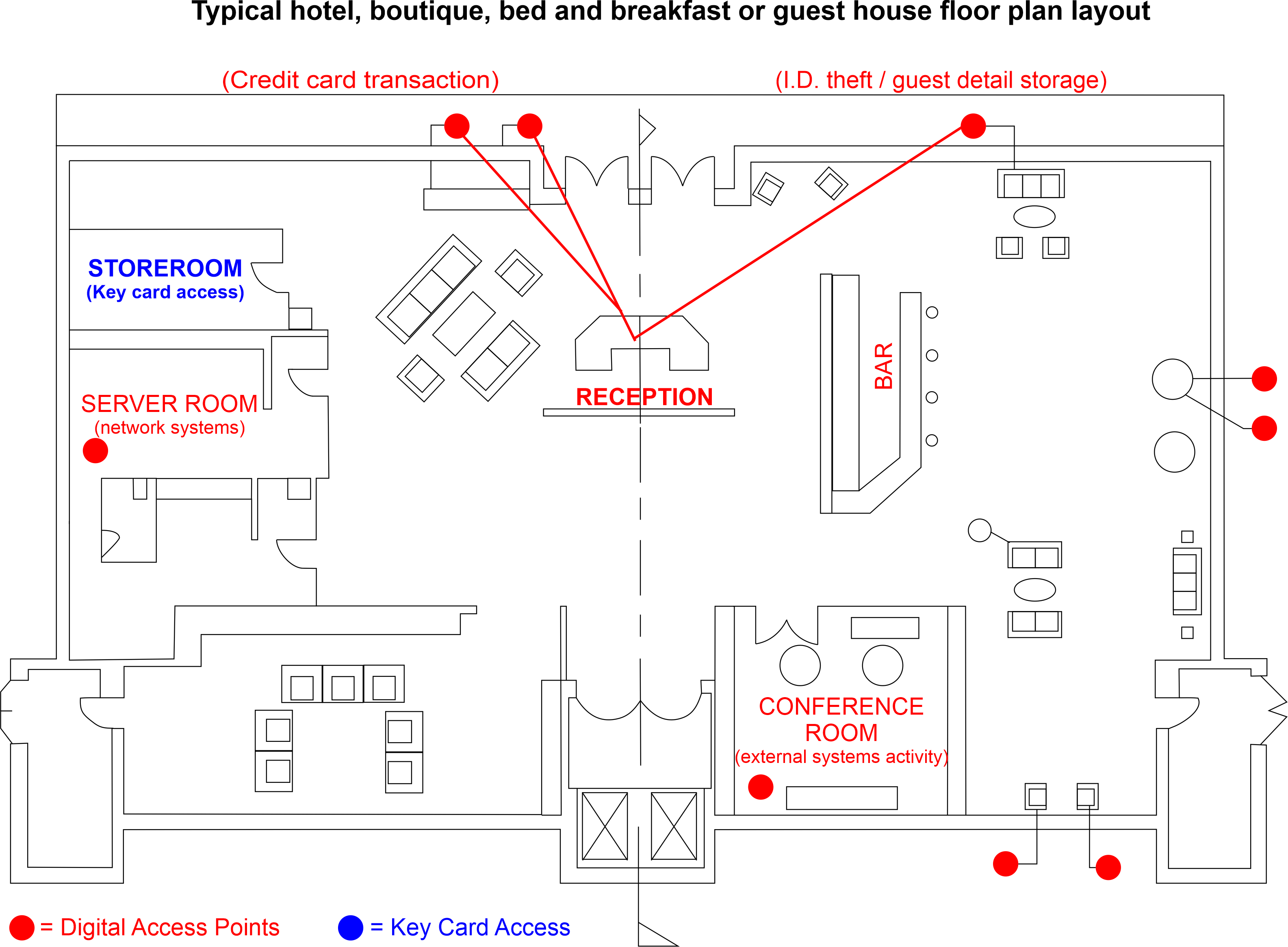

Consider the following common office/establishment floor plan layout and potential cyber-hack possibilities:

In SA, experts are warning that the threat has never been this severe – with businesses of every size across sectors at risk of being compromised by increasingly savvy cyber criminals. According to the South African Banking Risk Information Centre (SABRIC), SA currently has the third-highest number of cybercrime victims worldwide – with the country losing an estimated R2.2bn a year to cyber-attacks (fin24)

As an insurance broker who prides themselves on protecting our customers, we urge you to not ignore a very real threat to the well being of your business and staff. Contact SATIB insurance brokers for a free cyber quote now.

SATIB Cyber, underwritten by world leaders in insurance Lloyd’s of London, offers SATIB cyber policy holders with UNIQUE and EXCLUSIVE cyber protection covering.

Our Cyber policy can protect in the following ways:

Data breach incident response – Call our hotline to a pre-approved top breach response law firm, who will initiate an investigation and coordinate the response plan on your behalf. This hugely important support will guide you through the process of dealing with a potential or actual cyber event including doing the following:

- Engagement of forensic and IT security vendors to investigate the scope of the breach and provide expert response guidance.

- Identification of mandatory notification requirements.

- Assessment of voluntary notification options.

- Agreement of notification strategy / plan.

- Appointment of Call Centre / Credit Monitoring service providers.

- Public relations services.

- Mitigation of potential 3rd party liability actions

Network Security, privacy and data breach liability cover

Our product protects our customers for costs to defend and resolve liability claims brought against you as a result of a security or privacy event.

Regulatory Liability

Our product covers our customers’ regulatory fine (wherever legally permissible) and associated legal costs following a security or privacy event.

PCI Fines and assessments

This section of our product, if you accept credit card payments, covers our customers’ contractual fines and associated legal costs following a security or privacy event that affects payment cards.

Business Interruption

This section of our product gives cover for our customers’ loss of income following a security or privacy event.

Data Restoration

This section of our product gives cover for our customers’ costs for data restoration or recompilation following a security or privacy event.

Cyber Extortion

This section of our product gives cover for our customer’s costs incurred following a cyber extortion threat.

Media Liability

This section of our product gives cover for our customer’s costs to defend and resolve liability claims as a result of media wrongful act in the course of releasing any content on their website or via social media.

Cyber Crime/Social Engineering Extension

This section of our product gives cover for our customer’s financial loss relating to a social engineering event such as phishing.